- Savings

SavingsSave regularly, from as little as £5 per month.

SavingsSave regularly, from as little as £5 per month.- Member Account

- Family Member Account

- Junior Account

- Notice Plus Account

- Reserve Account

- Five-Year Regular Saver

- Festive Fund Account

- Discontinued Accounts

- Loans

LoansHelping you by offering a range of loans for a variety of purposes, direct from your payroll.

LoansHelping you by offering a range of loans for a variety of purposes, direct from your payroll.- Member Loan

- Consolidation Loan

- Commutation Loan

- Student Officer Loan

- Revolving Credit

- Green Loan

- Loyalty Loan

- 70+ Loan

- Credit Builder Loan

- Holiday Loan

- Additional Borrowing

- Discontinued Accounts

- Mortgages

MortgagesHelping the police family to get on and remain on the property ladder.

MortgagesHelping the police family to get on and remain on the property ladder.- Speak to a Mortgage Adviser

- Mortgage Calculator

- How to apply

- Agreement in Principle

- First Time Buyer

- Fixed Rate Mortgages

- Family Assist Mortgage

- Standard Variable Rate Mortgage

- Budget Planner

- Useful Contacts

- Financial Wellbeing

Financial WellbeingSome of our top tips to help you manage your money even better.

Financial WellbeingSome of our top tips to help you manage your money even better.- Managing Debt

- Representative APR

- Credit Score

- Gambling awareness

- Stop Loan Sharks

- Jargon Buster

- Fraud Awareness

- Family Financing

- Support for your wellbeing

- Let’s Talk About Money newsletter

- Services and Support

Services and SupportFind more information on the additional services or support we offer.

Services and SupportFind more information on the additional services or support we offer.- Interest and dividend rates

- Prize Draw

- Life Protection

- Notify us of your retirement

- FAQs

- Annual General Meeting

- About Us

About UsFind out more about the biggest police credit union in the UK.

About UsFind out more about the biggest police credit union in the UK.- About Us

- Board of Directors

- Mission Statement

- News

- Contact Us

Exploring Cryptocurrency

Written by: Ben Kirkman

Category: Let's talk about money

Read Time: 5 minutes

| Subscribe to our monthly “Let’s talk about money” newsletters here! |

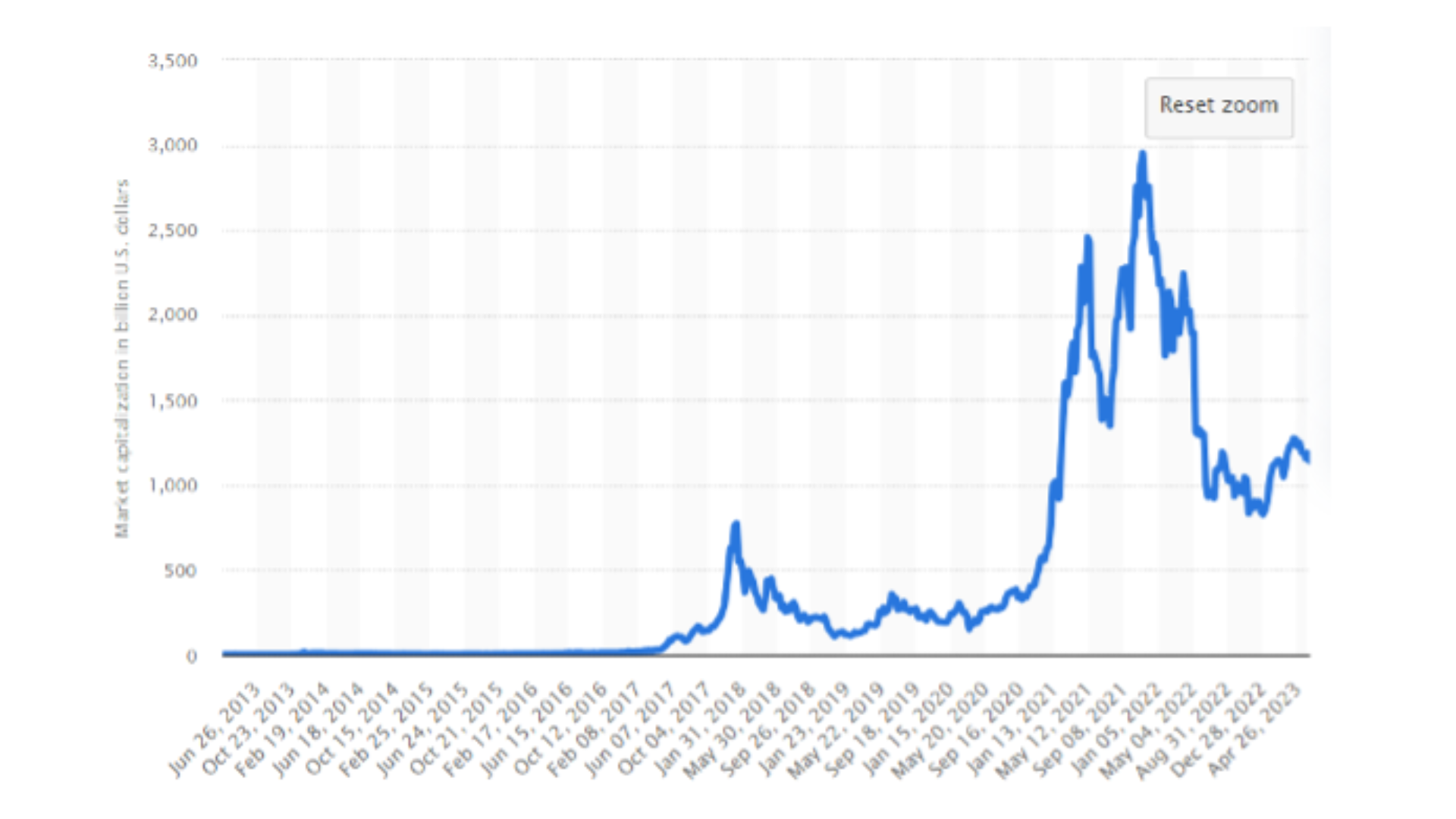

From its conception in 2009, Cryptocurrency has seemingly stuck around far longer than some people anticipated and awareness of it has risen in recent years. The market capitalisation of Cryptocurrency has seen a huge increase in the past ten years, from $1bn in 2013 to $1.5tn. In this article, we will share some dos and don’ts of how to approach Cryptocurrency safely and highlight some key risks.

- Crypto Market Capital between 2013 and 2023

- What is Cryptocurrency?

- What is blockchain?

- Why are Cryptocurrencies popular?

- Be on the lookout for scams and fake investment opportunities.

Crypto Market Capital between 2013 and 2023

What is Cryptocurrency?

There are thousands of individual Cryptocurrencies available, and all of them share a common theme of being a type of digital currency using cryptographic techniques to secure and verify transfers of funds. Bitcoin is the largest and better-known currency, followed shortly by Ethereum but there are many more. Each Cryptocurrency will have its own individual use, and these are dependent on the type of Project. Projects are what the currency was designed to do. Some can range from providing fast, private transactions or using the currency as a direct exchange for non-digital money.

Cryptocurrencies belong to a type of network called a Blockchain, these networks are often referred to as being ‘Decentralised’, meaning they can exist alongside but not influenced by governments and regulatory authorities. This is a major selling point for Cryptocurrency. There is no need for large institutions and individuals can essentially transfer money without a third party (i.e., a bank).

What is blockchain?

Why are Cryptocurrencies popular?

Now seen, by some, as a form of investment, some individuals will buy a Cryptocurrency at a particular price in the hope of making a profit. Historically, Cryptocurrencies have volatile price fluctuations, influenced by market trends, positive or negative press releases and the asset’s actual useability. It would be sensible to note that while investing in Cryptocurrencies could pose a lucrative purpose, there is overwhelming uncertainty about the authenticity of some projects. There is a real possibility that your investment value will exponentially decrease due to the volatile nature of the Cryptocurrency market. Some Cryptocurrencies are even wholly illegitimate and if seen to be fraudulent, your entire investment in that particular currency could be wound up.

This article isn’t designed to point you in either direction. The information is designed to outline some of the benefits and drawbacks of investing in cryptocurrencies.

Investing in Cryptocurrency opens the door for investors to diversify portfolios and investment strategies. It offers diversification of investment portfolios. Diversity allows investors to spread their money into more markets meaning less of their money is affected by one market. Typically, Cryptocurrencies have no or very little correlation to the overall trend of other markets, such as the stock markets or the housing markets. If the stock market doesn’t perform as well, it has little effect on the way Cryptocurrency will perform. Having a more diverse portfolio of investments could increase how resilient your money is to volatile market circumstances.

In some situations, Cryptocurrencies can be used as an actual form of currency, both physically and digitally. A smaller section of high street banks accepts Cryptocurrencies as a means of transferring money. The benefit being incredibly fast transactions with no or very little transactional fees. Not only is the blockchain incredibly fast, but it also boasts a high level of privacy and requires user anonymity as they only have a wallet address (a long series of characters specific to that user) and nothing personal tied to their accounts.

Be on the lookout for scams and fake investment opportunities

Following a large surge in interest, Crypto investing has seen an increase in potential scams and hacking attempts. Cryptocurrency is mainly unregulated in the UK, which means investments may not be protected by the FSCS.

It’s important to share some of the risks associated with investing. Unfortunately, this type of investment isn’t immune to scams and hackers. If you are currently invested or interested in investing, please be on the lookout for some of the red flags involved with Cryptocurrency.

-

Don’t assume a currency or the project it’s associated with is real. Scams are clever in making projects look visually legitimate. A quick due diligence check and a look around may de-bunk an attempted scam.

-

Don’t be pressured into making investments. Real Projects will never reach out directly asking for investment.

-

Create safe and hard to crack passwords for your investment exchanges.

-

Double check any transactions when sending anyone or even yourself any form of crypto. There are no options to revoke transactions. There will be no recourse for refunds if a Cryptocurrency is mistakenly transferred elsewhere.

-

Make sure you’re using reputable exchanges and software. Better known exchanges will have credibility meaning insolvency and software failures are rarer but can still happen.

If you have fallen victim to a scam or want more information on how to spot scams, you can visit the Financial Conduct Authority and Action Fraud web pages.

Always make sure you are investing safely. Equally, efforts should be made to only invest an amount of capital you can tolerate losing, especially in a high-risk sector such as Cryptocurrency. It is incredibly important that if you decide to invest in Cryptocurrency, then you do so on the back of your own research and due diligence. On the surface, projects can look attractive to the investor but upon closer inspection have turned out to be heavily layered scams. Doing your own research and inspection of projects can help minimise the risk of these scams as well as develop your own understanding on the Crypto environment.

Exploring alternative avenues to bolster financial resilience is undoubtedly commendable; however, it is crucial to proceed responsibly. Cryptocurrency presents a double-edged sword, demanding a cautious approach when engaging with this groundbreaking technology. While some organisations, like JP Morgan can be noted to have heavily invested into the Cryptocurrency exchange, the majority of UK banks still remain hesitant. Unfortunately, predicting its future in banking practices is beyond our capabilities. Regardless of whether Cryptocurrency endures or fades away, investors must comprehensively comprehend the risks involved.

*Please make sure to do your own research on cryptocurrency if this is something which you are considering investing in. The information provided in the article does not constitute financial advice or any recommendation and should not be considered as such. This article has been designed to give you a basic understanding of how cryptocurrency works.

| Subscribe to our monthly “Let’s talk about money” newsletters here! |

Written by,

Sam Bailey

Business Development Officer