| YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. Our mortgage products can change or be withdrawn at any time and are subject to underwriting. |

Are you hoping to help a family member to buy a house?

If you’re planning to support a child, grandchild or another family member in purchasing their home, then our Family Assist Mortgage could be the perfect solution. Please note you and your family member must be members of the Credit Union or eligible to join.

The product allows you to act as a guarantor for the mortgage deposit, on your family members behalf. This mortgage is available from just a 5% cash deposit from yourself, and you would be required to pledge the funds to the Credit Union in order to cover the guaranteed liability.

For example, if the property was £250,000, you could guarantee a minimum deposit of £12,500. These funds would be placed into the Credit Union’s Security Account, and access to the funds would become locked until the mortgage holder has repaid enough of the outstanding mortgage balance to cover the deposit. At this point, the secured funds would be released back to you.

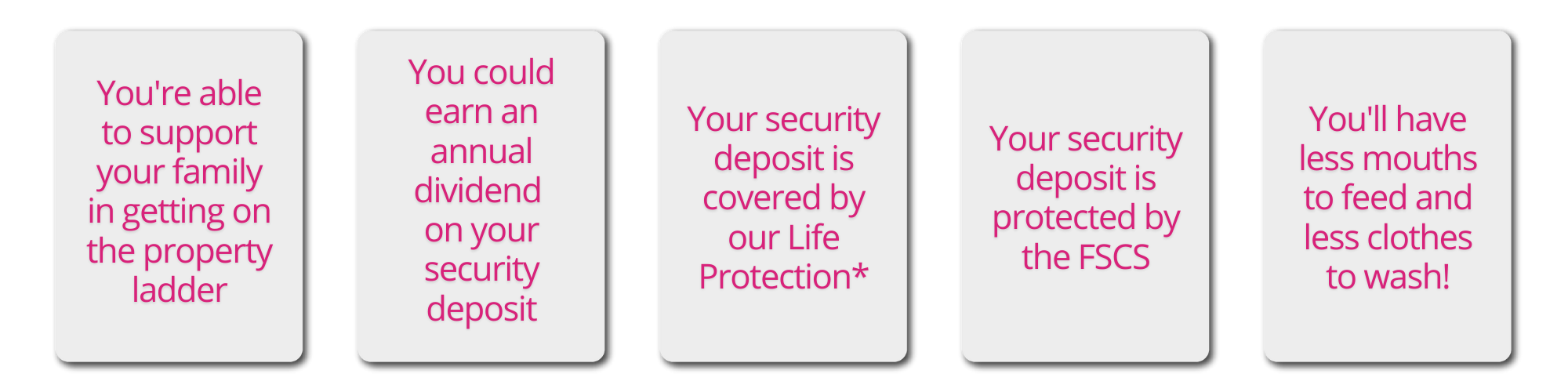

The advantages of this are that you get to help a family member to buy their own home whilst receiving an annual dividend payment on the security amount. This would match the dividend paid on the Member Account, in 2021 this was 1.0%. This way, you can help them to buy a home, whilst growing your savings simultaneously. Everybody wins!

Am I eligible?

- You and your family member must both be members of the Credit Union. Click here for more information on who can join

- You must have a cash deposit of at least 5% of the property purchase price

- You must be a UK resident

- You must be over 18

- The property your family member buys must be in the UK

|  |

Please click here to read our pre-contractual information for this product.

Current rate

| Product | Three Year Fixed Rate |

| Initial interest rate | 5.50% |

| Followed by SVR | 4.5% |

| The overall rate for comparison is | 4.9% APRC* |

| Arrangement fee | None |

| Early Repayment Charge** | 3% |

| The initial interest rate will be fixed for three years from the advance of the loan. | |

*The actual rate available will depend upon your circumstances. Ask for a personalised illustration.

**ERC of 3% of the outstanding loan amount is payable at the time of redemption during the fixed rate period.

Key information

| Mortgage amount | £25,000 up to a maximum of £300,000 |

| Maximum mortgage term | 35 years |

| Loan to Value (maximum) | Up to 100% |

| Over-payment charge | None (Up to 10%)* |

| Repaying your mortgage | You can repay through payroll deduction or Direct Debit |

*You can make over-payments on this mortgage throughout its term. Over-payments made within the first 3 years cannot exceed 10% of the original mortgage balance per annum from the date of completion. These over-payments would not be subject to the Early Repayment Charge.

Applicants must be no more than 75 years of age at the end of the mortgage term.